The aesthetics of industrial capitalism were those of contradiction. The same object contained the principle of exploitation, and the promise of liberation. The factory represented inhumane mass production, but also was a space for political struggle. On the other hand, contemporary capitalism (variously theorised as neoliberal, financialised, techno-feudal…) has progressively eliminated the emancipatory potential; solving the tension by refusing to admit that there is one. And yet, there is a yearning for contradiction.

In January 2021, millions of people around the world were buying shares of the brick-and-mortar videogame retailer GameStop. The idea originally came from Keith Gill, a Massachusetts analyst, who showed that the company’s stock was undervalued. It started gaining traction when the subreddit r/WallStreetBets realised that the shares were underperforming because a number of hedge funds were betting against the stock. People started to massively buy positions in GameStop not because they believed that the company was worth more than Apple and Amazon combined, but rather because they knew that doing so was a rare opportunity to damage financial corporations in their own turf. Using the master’s tools to make a dent in the furniture of the master’s house.

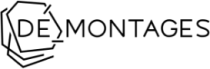

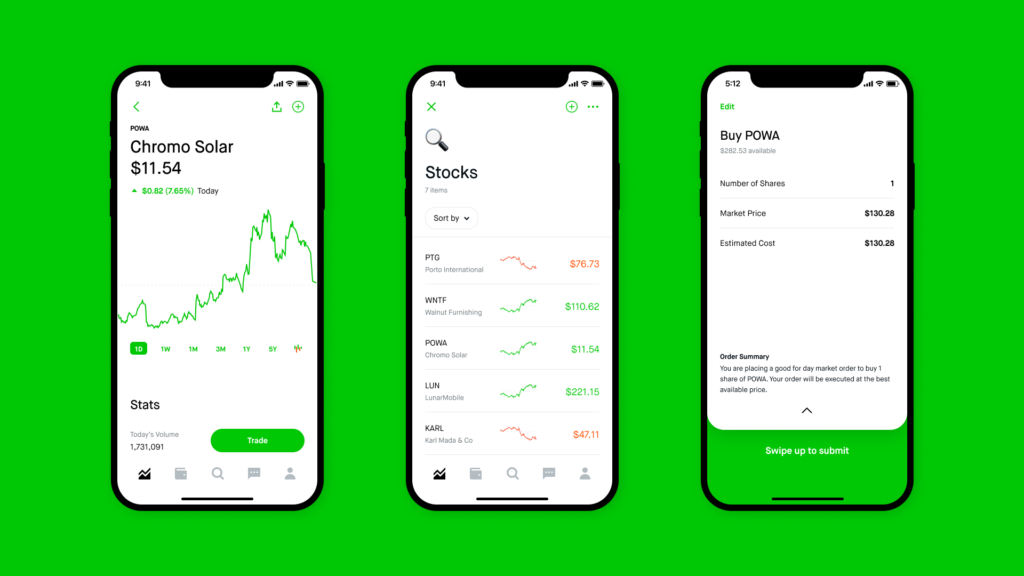

The GameStop Short Squeeze was emblematic of a wider media trend: the platformization of amateur trading. Over the course of the last decade, digital apps have come to replace traditional brokerages in the amateur markets. Services like Robinhood or eToro offer an intuitive user experience, integrating visual elements traditionally associated to finance to minimalist interfaces with bright colours. They also adopted peripheral affordances, like “reward stocks” in Robinhood, or a social media feed for eToro. Brokerage platforms have lowered the requirements to start trading: virtually anybody with disposable cash and a basic understanding of mathematics can sign-up.

The number of amateur traders has grown exponentially over the course of the last years, reflecting the platform’s claims to be “democratising finance” and “empowering users”. Access to financial products is presented as a vector of social mobility; as if the stock market is a walled garden of riches, and the apps are the key that entrepreneurial users could grab to let themselves in. These corporate promises were then repeated and amplified through social media, where useful tips, self-aggrandising boasting, and tantalising falsehoods seamlessly blended with each other. A diffuse political ideal formed around trading platforms. The belief in, or the willingness to play along with, the stock market was a starting point for a critique of social conditions, advocacy for wealth redistribution, and generalised mockery of the wealthy.

However, the emerging politics of the platforms clashed with their inner workings. Despite their lofty claims, trading apps do not allow users to directly interact with the financial markets. Robinhood has implemented a system called “Payment for Order Flow”. The users’ trades are algorithmically grouped together and then sent to third parties that buy the stocks and re-sell them to the users. eToro, on the other hand, has a closed market system. It buys shares in public markets, and then sells them to their users through their platform, allowing them to trade with each other, as well as with the company. The prices displayed on the app mirror those of the public exchanges, but that’s little more than a simulation. The trades on the platform are not part of a wider exchange structure, they exist in a self-contained (digital) space. Rather than being traders, users are consumers of financial products.

The tension between discourse and software reached its highest point during the GameStop Short Squeeze. Users demanded to be treated as more than consumers seeking to maximise their portfolios. They aspired to be fully-fledged investors, pursuing industry-specific goals that went beyond earning (or loosing) a quick buck. Doing so was too risky for platforms that were not designed to accommodate these approaches. After a brief panic, they simply decided to stop selling GameStop shares. It directly confronted their userbases with the fact that they were consumers, tied to whatever products their platform of choice offered them. For all the talk about the democratising finance, it proved that the investors capable of activism were those in Wall Street. Amateurs may watch the global game of finance, and even place bets on the side, but they are not welcome to sit on the table.

Ironically, the world of finance ended up ensuring the success of the GameStop Short Squeeze. As the posts on r/WallStreetBets turned viral, several institutional investors decided to jump into the bandwagon, buying considerably larger positions than those of the amateurs who had popularised the stock. These firms, and not the users, were responsible for the hefty price that their colleagues had to pay for betting against the stock. What started as a rebellion from below against the financial “whales” ended up as little more than a corporate hazing; and the person who lost the most money in this entire affair, Ken Griffin, decompressed after these stressful weeks by buying one of the last remaining copies of the U.S. Constitution.

Returning to the question of capitalist aesthetics, the events surrounding GameStop are informative because they demonstrate how digital media can sublimate conflict. Amateur investors, who attempted to use trading platforms as anticapitalists tools, found out that such possibility was never there. The software did not allow it. The user is not a trader; they are a consumer, and consumers are not supposed to be political actors. Disappointing? Certainly. Still, such realisation contains the kernel of a more radical approach. For conflict continues despite its attempted sublimation. Once it becomes clear that a media object does not contain an emancipatory potential, smashing it is more than justified.

References

Poell, T. & Nieborg, D. & van Dijck, J. (2019). Platformisation. Internet Policy Review, 8(4). https://doi.org/10.14763/2019.4.1425